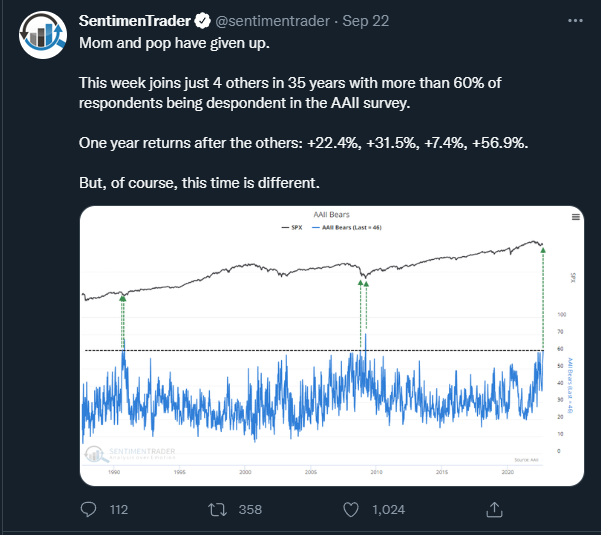

The sentiment out there is bad. One of my favorite Twitter accounts to follow for sentiment is Sentiment Trader (@sentimentrader). They posted this chart earlier this week:

but admittedly it feels like we are teetering on an edge. When its hard for me to call in buy orders I know we are getting closer to a bottom.

Reorg Content (subscription required)

- Performing / High Yield Credit - Reorg Covenants Weekly: Citrix LBO Notes Include Aggressive, Possibly Unprecedented Buildup Basket; NortonLifeLock’s Credit Agreement Expands Unused Carryforward Flexibility; Opendoor, LendingTree Initiation; Hersha Hospitality, Ultra Clean, StoneMor, Sylvamo Updates; CNX Resources, Citrix Primary Review - The feedback on my post last week on ability to submit documents for loan review was met with overwhelming response. As you can see we are covering a lot in the space and this content is absolutely incredible and best-in-class.

- Distressed Credit - Everything and all Puerto Rico. We wrote a litany of stories on Puerto Rico last week and with the island being super topical given the struggles at the island (and Luma featured on John Oliver). Our most popular story of the week: Oversight Board Files PREPA Bond Litigation Schedule With Call to Continue Talks; Latest Bondholder, Oversight Board Restructuring Proposals Disclosed

- The Sordid Saga of Hunter Biden’s Laptop - Given the House is most likely going to swing to Kevin McCarthy's leadership if I could buy mentions of Hunter Biden's laptop as a stock, it would be a screaming buy. As a don't like to get political here, this piece laid it all out there

- Has The Zodiac Killer Mystery Been Solved (Again)? - An incredible piece by LA Mag. I lvoe this random guy taking it to the next level...