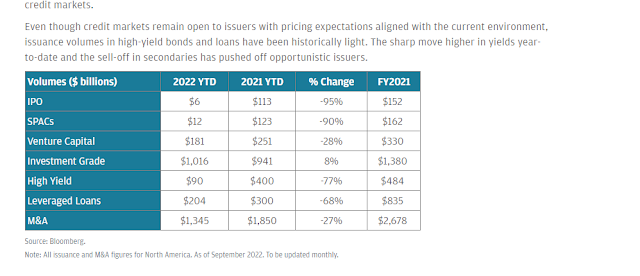

An incredible chart from JPM below...

The news that banks will hold Twitter debt and sell at a later date and private equity firms doing equity only deals are emblematic of the times. And as expected more creditor on creditor violence and aggressive capital structure management is happening as we speak. I would guess we are just in the first innings of that.

Reorg Content (subscription required)

- Performing / High Yield Content: Conversations with Reorg: Changing Dynamics in The European Leveraged Loan Market And The Potential Impact of More Permissive Documentation On Restructurings: Reorg has been massively ramped up our Expert Views series. This was one of my favorites of recent past

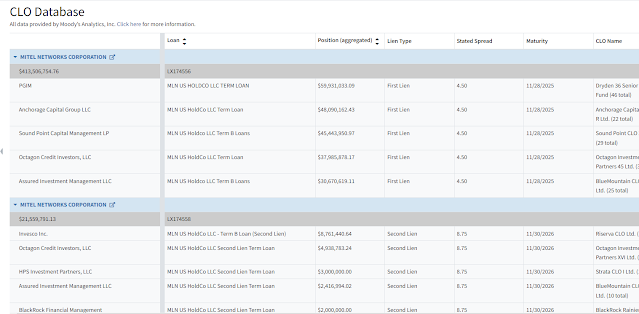

- Stressed / Distressed Content: Mitel Executes Non-Pro-Rata Priming Exchange With $857M of New Debt Ahead of Existing Loans: And it begins. Given the amount of capital raised in drawn down structures from credit opportunity funds and the weakness of governing documents, there are going to be a lot of these

Other Content You Mind Find Interesting

- The Crypto Story: Matt Levine comes out with a MONSTER piece (I'm only 1/2 done) on everything (and I mean everything) crypto. For people ultra familiar with the space I think you'll learn something new from all the anecdotes and missives

- The $30 Million Lottery Scam: I think one thing people are underappreciating is how long it takes the excesses to unwind in the market. Yes the UK pension scheme sorta blew up and Madoff was uncovered months after Lehman filed - that said I think you are going to see many many more shoes to drop over the next two years

Something I Bet You Didn't Know You Could Do On Reorg

Lets say you are a lender to a company going through some challenges. And we know a lot of companies are going through challenges. There could be ideas on amendments floating around or an uptier exchange or covenant breaches etc. If lenders wanted to organize they may call a desk or speak to lawyers to see who else is involved. Well all that data is on Reorg. Lets use a topical one: Mitel:

We've recently rolled out some data initiatives to better display and link the data across Reorg's databases. You'll see more of this data in Reorg stories soon. To access the database you can go here: Reorg CLO Database

No comments:

Post a Comment