Takeaway Tuesday #9

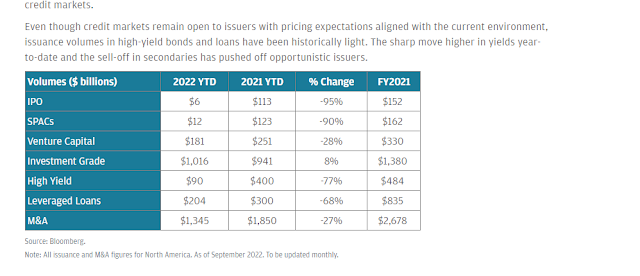

Happy Tuesday everyone. Its been a busy couple weeks post Reorg's FinDox announcement. Markets have been strange at best. I do think we are in an interesting period of alpha vs long risk. The Buffet 10 year bet (which Buffet won easily) could go the way of the active fund vs long S&P. Credit markets are still nearly closed, PE feels like its sitting on its hands and everyone is waiting for earnings estimates to come down. I would be remiss to not mention the absolute crazy of FTX and other crypto bankruptcies (there are more coming...). John Ray's declaration in FTX may be top 5 docket items I've seen in my career. FTX / Crypto were 9 out of Reorg's top 10 stories in the U.S. last week. Rightly so as this is this generation's Lehman / Enron and there are A LOT of claims out there for pennies on the dollar...

Reorg Content (subscription required):

- Performing / High Yield Content: All the work on Tenneco and Nielsen the teams did last week. Obviously a big test for the health of market (some wins, some losses). Remains to be seen how this affects the forward calendar going into the holiday season

- Distressed Coverage: Obviously FTX huge highlight last week. Removing that, the Copper Standard situation has fascinated me for the last couple of years. Its interesting to see and break down their TSA

Other Content You May Find Interesting

Only one link today because its one of the best reads in a long time: Notes from Todd Comb's conversation at the Graham & Dodd Annual Breakfast 2022. Run to read it...here are my four biggest takeaways:

- "Combs goes to Buffett’s house on many Saturdays to talk, and here’s a litmus test they frequently use. Warren asks “How many names in the S&P are going to be 15x earnings in the next 12 months? How many are going to earn more in five years (using a 90% confidence interval), and how many will compound at 7% (using a 50% confidence interval)?” In this exercise, you are solving for cyclicality, compounding, and initial price. Combs said that this rubric was used to find Apple, since at the time the same 3-5 names kept coming up."

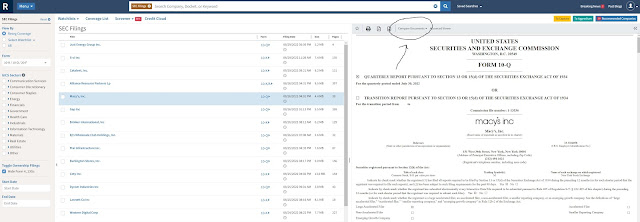

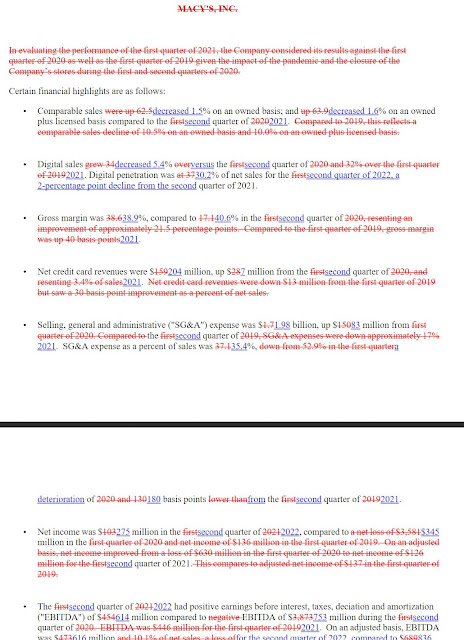

- " Combs mentioned how his responsibilities are great, and his time is scarce, but if he was 150% dedicated to analyzing companies, he’d focus on delta reports, and see what management is changing from year to year. In 2005, Bear Stearns changed something very essential in their reports while saying something different to the street."

- "Put together your view without looking at the market cap. Limit the pollution. Then think about the future of the company and pressure test your assumptions. "

- "Combs focuses on fundamental unit economics. “First figure out CAC and LTV for GEICO. You know the data of where they live, the kind of car, and then there is the LTV of the customer. Combs thinks where people go wrong is where they think they know their CAC and LTV but it’s from too high a level. When you slice the data, there are really big pockets where the LTV is negative, and that is where the potential is to improve margins.”"